Tenacity of Technology, Audacity of Humanity - My Reflections from WEF 2023

At the World Economic Forum held recently at Davos, the theme was Cooperation in a Fragmented World. As we enter a new era of accelerated poly-crisis, I took away six key thread which I believe will define the future for the business, economy and humanity.

In an interconnected world straining under the burden of its own complexity, numerous factors are coming together to make the global environment more unpredictable and difficult to navigate. In global governance, we are seeing the balance between nation-states and the institutional framework that worked to manage it disintegrating. In its place, we are witnessing new geo-economic competition, new regionalism, and new actors.

Meanwhile, the technological changes over the last two decades, called the Forth Industrial Revolution, are disrupting our businesses. The advances in all the sciences – from robotics and genetics to communications and the social sciences – will leave no aspect of global society untouched.

Against this backdrop, the World Economic Forum (WEF) session was held three weeks ago at Davos, Switzerland, between the 16-20th of January.

The motto of the World Economic Forum (WEF) of "Committed to Improving the State of the World" has always resonated with me. Since its inception in 1971 as a non-profit foundation, the forum is known to engage the foremost political, business, cultural, and other leaders of society to influence, shape and reflect on the global, regional, and industry agendas.

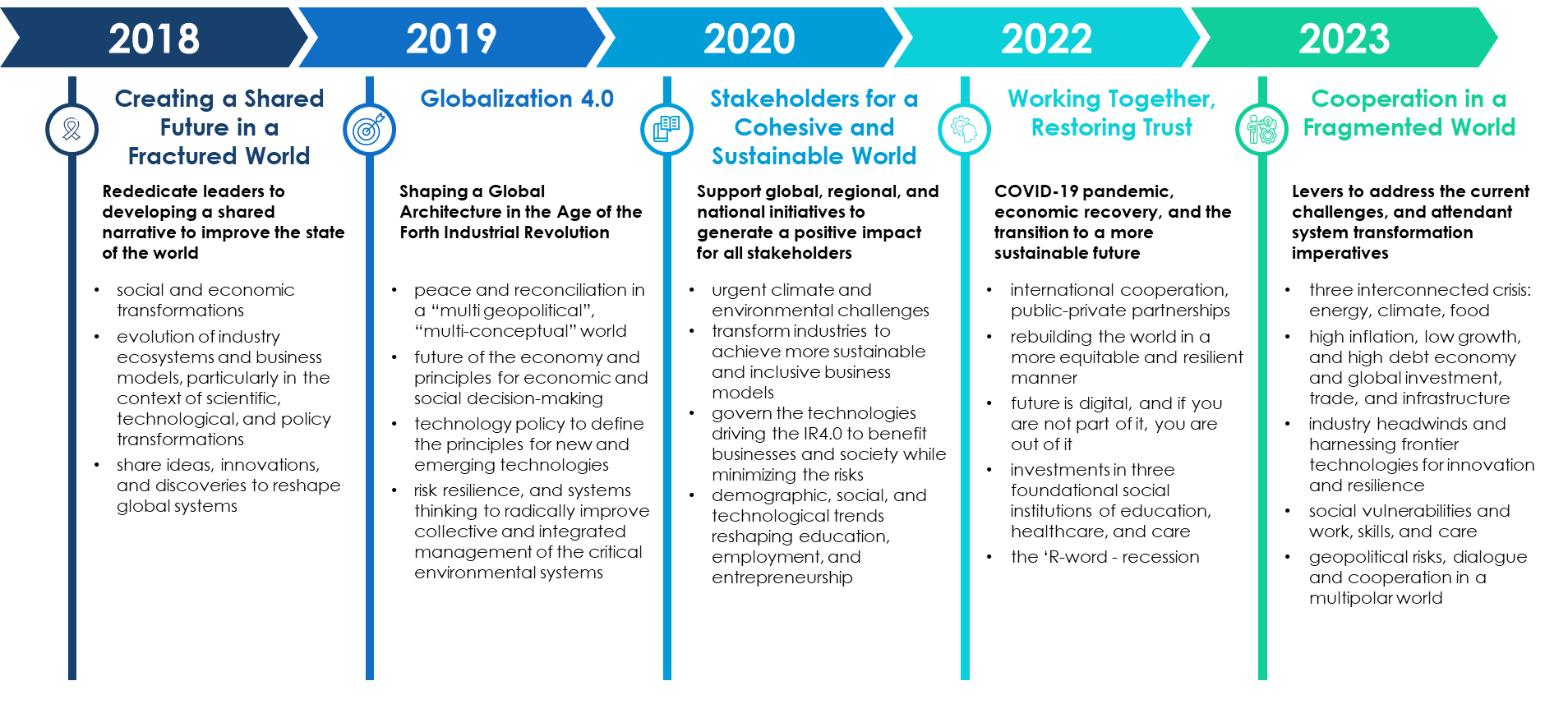

Over the years, the themes and topics at the WEF have evolved while reflecting the state of affairs and the key challenges and opportunities. But, we see a pattern for sure - Disruption and Forth Industrial Revolution, Fragmentation and Deglobalization, Sustainability and Climate Change, Cooperation and Collaboration, Impact and Stakeholder Capitalism.

This year's theme for WEF 2023 was "Cooperation in a Fragmented World."

After a fairly warm winter in Switzerland and wider Europe this year - arriving from Zurich, my hometown, to Davos, covered in a few inches of snow, was a wonderful start to my experience of being there on the ground Zero.

And, more often than not - quite a few great sessions were being run in parallel - and some lively conversations going on around the corridors - made me wonder - why did we stop the Human Cloning project! (assuming that's the case!).

With nearly 240 sessions, more than 2,700 leaders – including over 350 public figures, government leaders, and 47 heads of state – came together this year at the WEF 2023 to talk about and address the world’s most pressing challenges.

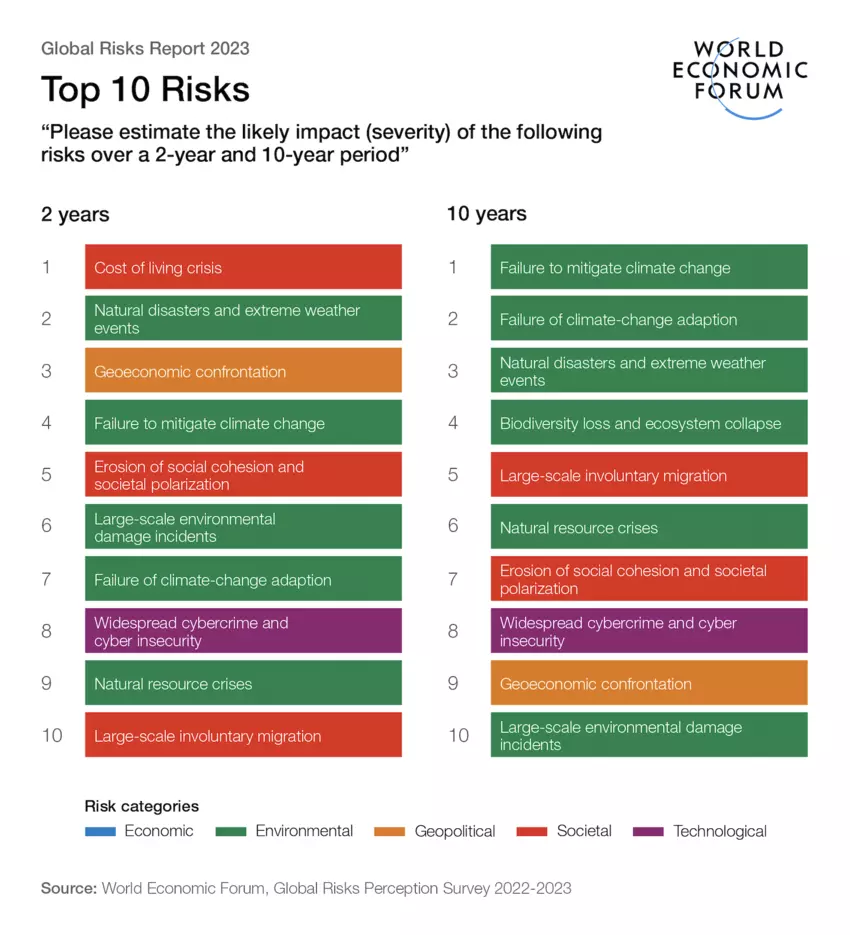

WEF also released quite a few insightful publications aligned with this year's theme and the main topics in focus, the most significant perhaps being the Global Chief Economists Outlook and the Global Risks Report.

The 2023 Chief Economists Outlook has highlighted the continuing economic uncertainty and challenges of historic proportions. As the world puts another tumultuous year behind it, governments, businesses, and households are expected to grapple with persistent headwinds throughout 2023. Financial conditions remain tight, with little scope for significant loosening, despite the fact that much of the world economy is at risk of recession. Twice as many experts consider the risk of recession to be a reality compared to the earlier report published just a few months ago in September'22.

Both reports highlighted that the economic aftereffects of COVID-19 and the war in Ukraine have ushered in skyrocketing inflation and rapid normalization of monetary policies. We are likely entering a low-growth, low-investment era ad faced with risks that feel both wholly new and eerily familiar.

The Global Risks Report 2023 talks about some of the most severe risks we may face over the next decade. ➡️ the ongoing geopolitical fragmentation would drive geo-economic warfare and heighten the risk of multi-domain conflicts. ️➡️ technology will exacerbate inequalities while risks from cybersecurity will remain a constant concern. ➡️ climate mitigation efforts are set up for a risky trade-off ➡️ food, fuel, and cost crises will exacerbate societal vulnerability while potential declines in the investments toward human development erode future resilience.

From the different sessions I joined and the conversations I had on the sidelines with fellow participants, I identified SIX KEY THREADS that were being focused upon, resonated with me, and potentially will define the future for the businesses, economy, and humanity at large.

Below I have summarized the six threads and my key takeaways and reflections.

1.Stewarding Responsible Capitalism: From Balance Sheet to Value Sheet

🔹Though perhaps slow, we are seeing the momentum in a shift from "growth and profits" to "impact and sustainability" being the boardroom and senior leadership mantra in the corporate world.

🔹There's quite a lot of progress made over the years to shift towards non-financial reporting - People, Profit, Planet. We now need a convergence of reporting standards globally at speed to ensure transparency and trust.

🔹People (Employees and Customers) are becoming increasingly connected to an organization's mission and purpose, driving loyalty and engagement.

🔹Against a backdrop of persistent inequality, the new generation includes a growing number of people demanding more of companies, looking for them to play an active and constructive role in creating societies that are more just and inclusive.

🔹Living Purpose in tough times is imperative, especially if you as a business leader and an organization want to be trustworthy.

An organization could be seen as a combination of the Brain (Professionalism), Heart (Passion), Muscles (Implementation), and the Nerves (Perseverance). These all need to be tied together by the Soul (Purpose).

2. Globalization: End of an Era?

🔹Flows of capital, goods, services, and people have boosted productivity and living standards, tripling the size of the global economy over the past three decades. But, this has also led to us over-dependency on a few specific countries.

🔹We are no longer searching for the lowest costs, but resilience (and profits). No more eggs in one basket! As the cost of further disintegration severely outweighs the benefits, it would require reshaping the current system to develop a new agenda for trade, growth, and investment.

🔹Perhaps ironic, but a harsh reality post-COVID and Ukraine-Russian crisis is the shift towards "de-globalization," aka "re-globalization," with the underlying message being "national security."

🔹With the current competition of ideologies between reshoring, offshoring, and distributed shoring, businesses and political leaders would need to successfully navigate the reshuffling of global value chains to enable resiliency, sustainability, and inclusive growth.

This "re-globalization" gives an opportunity not to replicate existing operations but to reimagine the supply chains toward sustainability and resilience and lay the foundations for a "circular economy."

3. Financial and Banking Systems: At the Crossroads

🔹The global banking system is un-bundling and re-bundling around the digital architecture. It's now a given that we need banking, but not banks.

🔹While the evolution of neo-banks over the last decade has enabled democratization of finance, yet even now 24% of adults remain unbanked and about only half of all adults in developing economies can access funds within 30 days to cover an unexpected expense. We need to bridge this gap at the earliest.

🔹The recent boom and bust in the crypto markets, compounded by the dramatic volatility in 2022 has created a FUD (Fear Uncertainty Doubt) but potentially a silver lining as well. We need to craft sufficiently robust regulations to realize the benefits of digital currencies while ensuring positive macroeconomic and societal outcomes.

🔹We have genuine issues in the current global financial systems such as a lack of access and inclusion, and inefficient payment systems. But, we can't also afford to have "A Hammer in search of a Nail."

🔹Governments, Regulators, and private sector institutions need to codesign globally uniform policies and sandboxes - else we are bound to witness unequal playing ground - a recipe for arbitrage and potential misuse.

We can't overregulate and suppress innovation, but we can't also afford to underregulate and allow the wild west.

4. Climate Change, Energy Transition, Sustainability: The Ticking Bomb

🔹The Titanic is sinking and we can't afford to just rearrange the chairs.

🔹We are attempting to nullify the impact of 250 years of damage over the next 25 years. While there are many advocates of de-growth, we need to understand that it is similar to having a river without water or a tree without roots.

🔹While the world is facing a global energy crisis, an estimated 2.3 billion people lack access to adequate food. This is exacerbated by a looming water crisis, with droughts and floods further threatening food production and human health.

🔹More than half of the world’s population lives in urban areas and this is expected to increase to almost 70% by 2050. The global consumer class is projected to grow to more than 5 billion people over the next 10 years, driving a 50% increase in consumer spending. To meet the demands of the global population of 10 billion responsibly, the production and consumption models would need to be environmentally sustainable and promote societal well-being.

🔹From hydrogen to metals mining and processing to battery production, the transition to more sustainable, accessible, and productive energy systems depends on the availability of critical materials and the enabling infrastructure. These need to be galvanized against the geopolitical, supply chain, and technological vulnerabilities at play.

🔹While over $130 trillion of private capital has been committed to net zero, over 60% of the decarbonization technologies needed to transition the industrial and mobility sectors are not available at commercial scale. The growing number of innovative financing mechanisms would need to improve the bankability of net-zero projects and unlock the investments needed to decarbonize economies.

🔹Energy security, affordability, and sustainability are cornerstones of a successful energy transition. In a time of stifled supply, slow emission reduction, and discrepancies in energy access between advanced and developing economies, the global energy transition need to be inclusive and accelerated.

The envisioned transition won't happen overnight - we need to plan for a shift from BLACK to BROWN to GREEN.

5. Big Bets: AI, Metaverse, Connectivity, Quantum

🔹5G will be a game changer, expected to democratize computing power. But making it available to 60% of the currently unconnected global population will be the holy grail. India and China leading the way, and Europe was seen as a laggard.

🔹Artificial Intelligence is at the cusp of a revolution - Large Language Models will get followed by NeuroSymbolic AI and, thereon, Integrated Knowledge AI. They will help expand the human mind like a painters' brush, and enable the shift from automation to augmentation.

🔹Fun Facts - ChatGPT was seen as a "confident bullshitter" :). And, a quick show of hands from the participants during one of the sessions showed that while 100% had experimented with ChatGPT (or equivalents), only 5% had their organizations starting/planning to leverage such AI capabilities immediately.

🔹While the metaverse is still in its infancy, investment in its development has accelerated with top global players investing an estimated $180 billion in the past few years. The evolution and adoption are likely to be similar to what we witnessed in the mobile space, just faster! We need a safe, accessible, and economically viable metaverse to be operationalized.

🔹We are witnessing new technologies and use cases virtually every day - from fast fashion biodegradable clothes with an expiration date, to mixing CO2 with water to make food to creating synthetic genome DNA in NFT as an asset class.

🔹Two key vectors of technology-driven development are at play. First, to create something new or improve what we already have. Second, to leapfrog in making what we already have more accessible.

🔹An average person is estimated to be spending almost 7 hours per day in front of a screen - it has a huge effect on the man-nature relationship and overall human health and well-being. Should we be worried?

🔹Only 4% of experts worldwide are 'confident' that connected devices are properly secure. “This is a global threat, and it calls for a global response and enhanced and coordinated action,” said Jürgen Stock, the Secretary-General of the International Criminal Police Organization (INTERPOL).

🔹Big companies with deep pockets can certainly afford to spend money, but we will continue to see new frontiers and disruption opportunities being crafted at the edges by the new kids on the block.

🔹Business leaders are still seen to be embracing technology for its sake and the hype of it. We must consciously and actively work on practical use cases (beyond proof of concepts) to create value.

The biggest issue in Digital Transformation has been and will remain not the Technology but the human side of Change Management.

The irony is that the speed of light sucks. No matter how fast we move, we will still be slower :).

6. Workforce of the Future: Seizing the Opportunities

🔹A recent Gallup global poll showed the highest level of fatigue ever recorded. Quiet Quitting, Great Resignation, and Career Cushioning are all the new realities of the corporate world.

🔹A globally implemented living wage could generate $4.6 trillion in additional GDP each year through increased productivity and spending. Amid a worsening cost of living crisis, should we radically reimagine a world with living wages for all?

🔹Stanford University recently looked at 950 occupations and didn't find any job role which could be completely replaced by RPA. AI and similar automations.

🔹Displacement of jobs will be a reality, especially in the white collar. Businesses and individuals would need to focus on skills instead of jobs and roles - especially in terms of upskilling and reskilling to unlock talent.

🔹Digital along with Creativity will be the Skills of the Future. In 2020 already, a number of software engineers hired by non-tech companies was higher than that hired by mainstream technology companies.

🔹Recent large-scale experiments suggest that workers’ hours can be cut without a corresponding drop in output. Can the four-day workweek address some of the most urgent problems in the 21st-century world of work?

With the recent technological breakthroughs, we are approaching an inflection point and a new disruptive era for knowledge workers.

IN CONCLUSION

As World Economic Forum President Børge Brende stated in his closing remarks,

"In an uncertain and challenging time, one thing is clear. We can shape a more sustainable and equitable future, but the only way to do so is together."

It would be arrogant for anyone to say that they know what will happen in the future, but surely enough we all have a crystal ball - even though it works only for the present. Annie Duke argues in her book, Thinking in Bets: Making Smarter Decisions When You Don’t Have All the Facts, “Wrapping our arms around uncertainty and giving it a big hug will help us become better decision makers."

So.....

ExO Insight Newsletter

Join the newsletter to receive the latest updates in your inbox.